Irs Tax Credit Ev 2025. A modern tax administration system is key to achieving the economic, energy security, and climate goals of the inflation reduction act. Jan 1, 2025 at 3:09pm et.

Federal incentives include a 30% tax credit up to $1,000 for electric car chargers and installation costs. A modern tax administration system is key to achieving the economic, energy security, and climate goals of the inflation reduction act.

Federal incentives include a 30% tax credit up to $1,000 for electric car chargers and installation costs.

The irs has made the ev tax credit easier to obtain, and in 2025 it’s redeemable for cash or as a credit toward the down payment on your vehicle.

Here are the cars eligible for the 7,500 EV tax credit in the, But experts expect it to grow. Federal incentives include a 30% tax credit up to $1,000 for electric car chargers and installation costs.

Pa Ev Tax Rebate Siana, Oct 6, 2025 at 8:45am et. 1, ev buyers no longer have to wait until they do their taxes to get the.

Form 8962 Printable, The tax credit extends through dec. Beginning in 2025, buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit.

UPDATE Here Are All The EVs Eligible Now For The 7,500 Federal Tax Credit, The federal tax credit for evs, up to $7,500, is going to get easier to pocket in 2025. A modern tax administration system is key to achieving the economic, energy security, and climate goals of the inflation reduction act.

How to Navigate the Fed’s New EV Tax Credit Nightmare, For ev customers, everything changes on january 1, 2025. Page last reviewed or updated:

IRS Form 1040 Schedule 8812 Download Fillable PDF or Fill Online, Department of the treasury and internal revenue service. For buyers to be eligible to.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Beginning in 2025, an eligible clean vehicle may not contain any battery components that are manufactured by a foreign entity of concern and beginning in 2025. Frequently asked questions about the new, previously owned and qualified commercial clean vehicles credit.

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, The tax credit extends through dec. Page last reviewed or updated:

/https://www.forbes.com/wheels/wp-content/uploads/2023/01/EVLeaseCredit_Main.png)

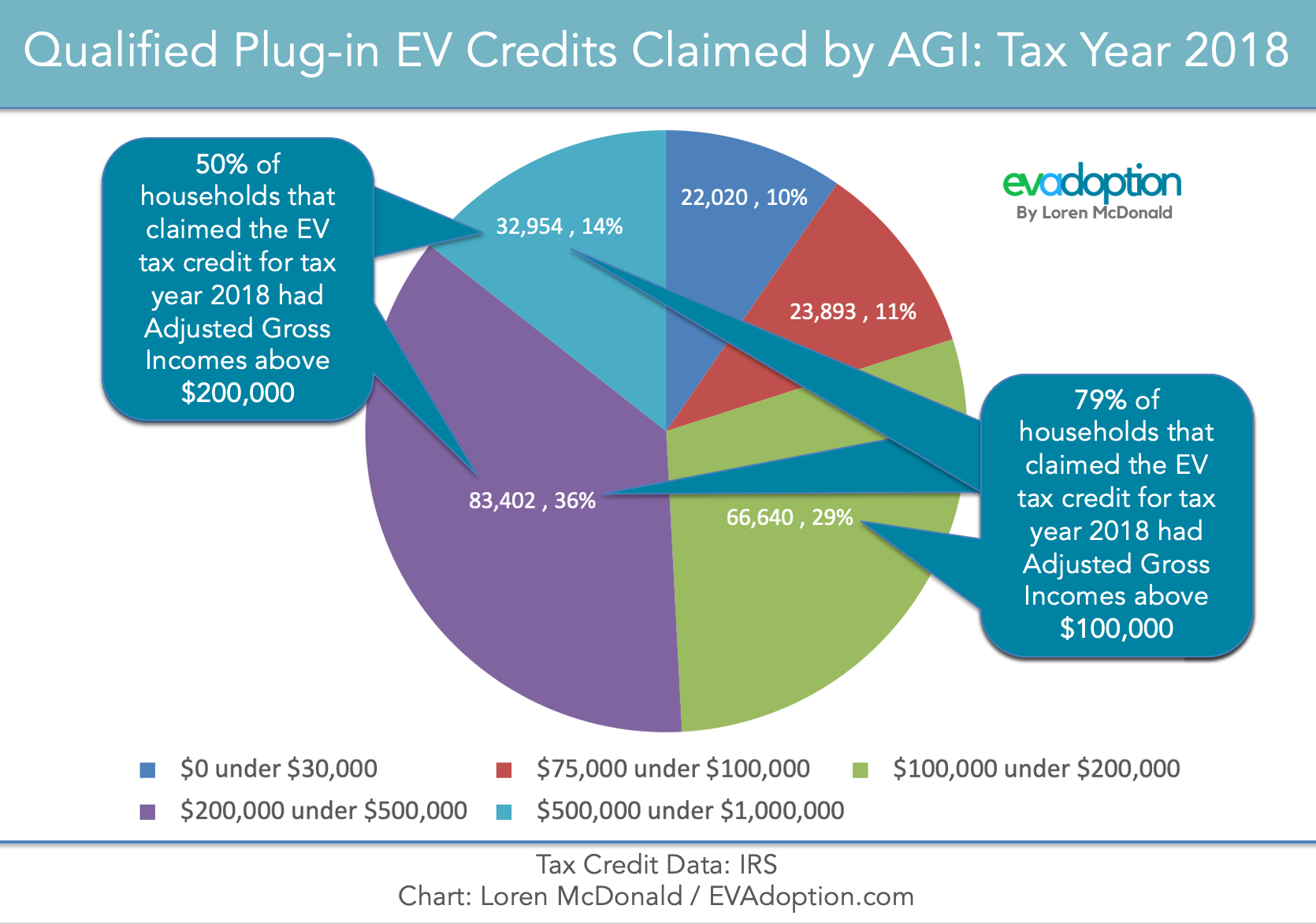

IRSTaxcreditbyHouseholdAGI2018updated EVAdoption, The irs has made the ev tax credit easier to obtain, and in 2025 it’s redeemable for cash or as a credit toward the down payment on your vehicle. What to know and how to qualify a guide on how to qualify for up to $7,500 in tax savings.

No Tax Credit For An EV? Try Leasing. Forbes Wheels, The irs has made the ev tax credit easier to obtain, and in 2025 it’s redeemable for cash or as a credit toward the down payment on your vehicle. Find the current list here.

The irs has made the ev tax credit easier to obtain, and in 2025 it’s redeemable for cash or as a credit toward the down payment on your vehicle.

Beginning in 2025, buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit.